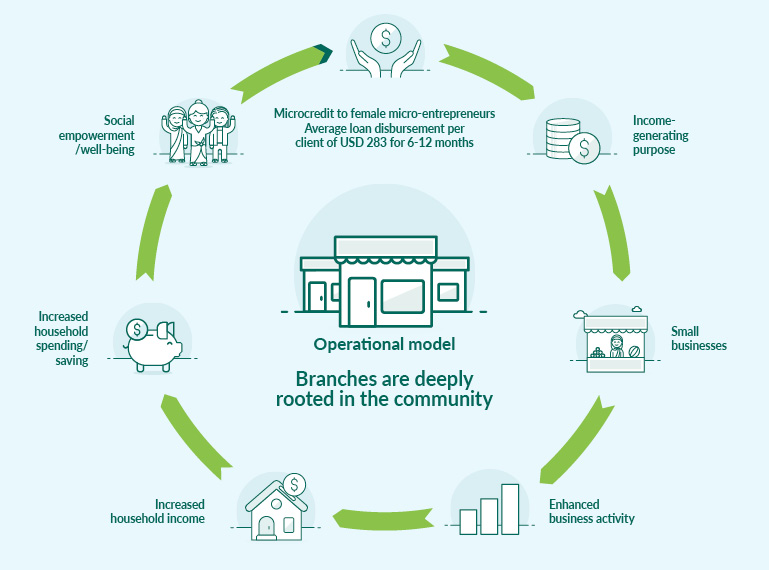

Socially responsible business model

Read more about the distinguishing figures of the ASA Model in our key differentiators

The ASA Model is a decentralised, standardised and socially responsible microfinance approach that allows for cost efficiency, quick decision-making, replicability, and high-touch client engagement, while addressing the demand for savings and loans, and over time, digital financial services.

- Target ~1,200 clients per branch (12km radius).

- Self-sufficient branches with on- and off-site supervision.

- Weekly/fortnightly loan collections and disbursements.

- Collateral-free, individual loans with market rates for income generation.

- 90% primary loans1; 10% small business/SME loans.

- Full repayment required before new loan (20-50% increase).

- Deposit growth as licences increase.

- Funding from local financial institutions, development banks, and MFI funds.

1 Primary loans is the loan product with the smallest loan size for working capital purposes of the products we offer in a particular country.