Socially responsible business model

Read more about the distinguishing figures of the ASA Model in our Investment Case

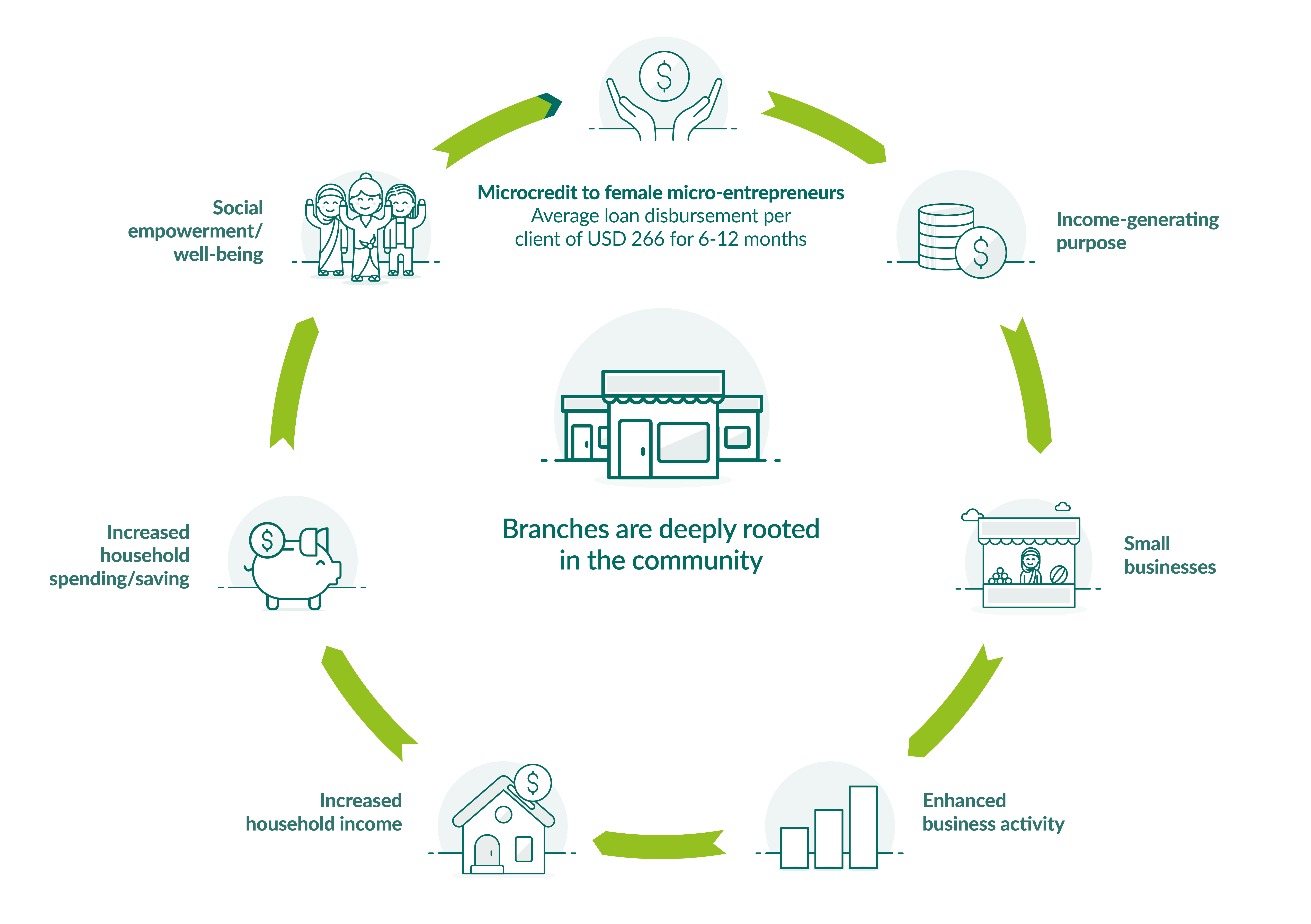

The ASA Model is a decentralised, standardised and sustainable microfinance model that allows for cost efficiency, quick decision-making and replicability, while meeting the basic demand for savings and loans, and over time, also digital financial services.

- Target ca. 1,200 clients per branch within a ca. 12km radius.

- Self-sufficient branches strictly monitored with on- and off-site supervision.

- High-touch client interaction through mostly weekly or fortnightly loan collections and disbursements at the branch.

- Collateral-free, individual loans for income-generating activities with market-based interest rates.

- 90% of outstanding loan portfolios are primary loans, with the remaining portion being small business/SME loans.1

- Full repayment before qualifying for new loans and repeat loan cycles with set limits (20%-50% increase).

- As the number of deposit-taking licenses increases, the levels of deposits will rise.

- The main sources of funding are from local financial institutions, development banks and microfinance loan funds.

1 Primary loans is the loan product with the smallest loan size for working capital purposes of the products we offer in a particular country.